U.S. April Jobs Report Offers Relief, Focus on FOMC

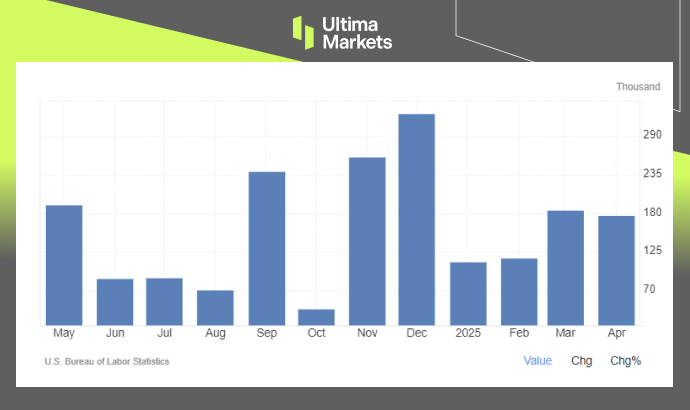

TOPICSThe U.S. labor market showed continued resilience in April, offering relief to investors concerned about a potential slowdown. Non-Farm Payrolls increased by 177,000 Jobs exceeding market expectations of 130,000, while the US unemployment rate holds steady at 4.2% in April.

US Non-Farm Payroll Data; Source: US Bureau of Labor Statistic

The stronger-than-expected job growth, despite being slightly below March’s revised figure, signals that the U.S. economy remains on solid footing. Gains were broad-based, with notable hiring in health care, professional services, and leisure sectors.

Wage growth also remained moderate, easing fears of persistent inflation and giving the Federal Reserve more flexibility in its monetary policy path.

Market participants interpreted the data as a positive sign, with equity markets holding firm and expectations for a potential Fed rate cut in the second half of 2025 remaining intact.

Federal Reserve Policy Path in Focus

The resilient U.S. labor market data provided a boost to equities, but the U.S. dollar showed limited reaction as investors now shift focus to the Federal Reserve meeting this week.

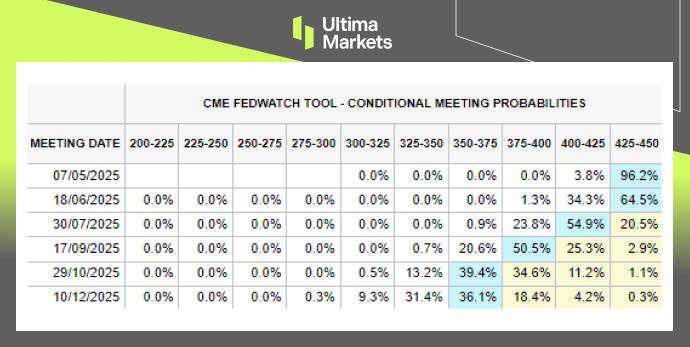

While the Fed is widely expected to keep rates unchanged, markets are increasingly pricing in the possibility of a rate cut as early as mid-2025. Attention will be on any forward guidance regarding the timing—whether in June or July—and the potential scale of future cuts.

CME Fedwatch Meeting Probabilities; Source: CME Group

According to the CME FedWatch Tool, markets currently see July as the most likely window for the Fed’s first rate cut this year, with expectations for a total of three cuts in 2025.

Market Implication: Dollar Holds Steady

The U.S. Dollar remained largely unchanged, as expectations for a mid-2025 rate cut—potentially totaling two to three cuts this year—have already been priced in. This early pricing explains the limited dollar reaction, although the currency remains vulnerable if the dovish outlook persists.

However, with recent signs of economic slowdown, even as the labor market shows resilience, the softer-than-expected data may prompt the Fed to adopt a slightly more cautious tone at this meeting.

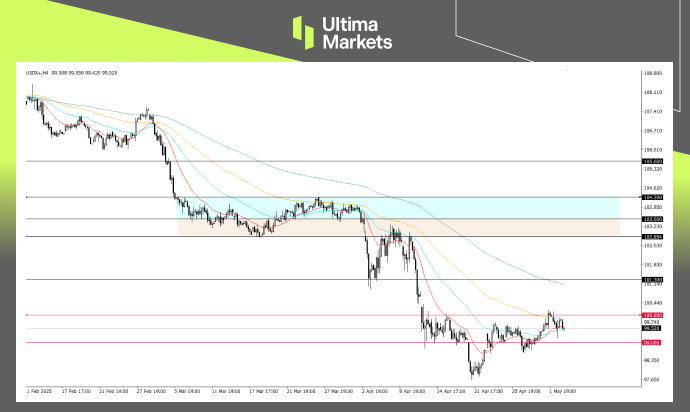

Should the Fed lean more hawkish than anticipated, the dollar could see a short-term rebound, especially as it holds a key technical support zone near the 100 level.

USDX+, 4-H Chart; Source: Ultima Market MT5

The US Dollar Index (DXY) continues to hold ground within the 100.0–99.0 range, reflecting indecision among traders ahead of this week’s Fed meeting. The upcoming policy decision could be the catalyst for a breakout.

A hawkish tone from the Fed may lift the dollar above the 100-mark, reinforcing short-term upside momentum. Conversely, a dovish stance could trigger renewed weakness, pushing the index lower within its current range.

Disclaimer

Comments, news, research, analysis, price, and all information contained in the article only serve as general information for readers and do not suggest any advice. Ultima Markets has taken reasonable measures to provide up-to-date information, but cannot guarantee accuracy, and may modify without notice. Ultima Markets will not be responsible for any loss incurred due to the application of the information provided.

Why Trade Metals & Commodities with Ultima Markets?

Ultima Markets provides the foremost competitive cost and exchange environment for prevalent commodities worldwide.

Start TradingMonitoring the market on the go

Markets are susceptible to changes in supply and demand

Attractive to investors only interested in price speculation

Deep and diverse liquidity with no hidden fees

No dealing desk and no requotes

Fast execution via Equinix NY4 server