Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Y A K L A Ş A N L A R

- Tümü

- Temettü

- Ürün güncellemeleri

- CFD Geçişi

- İşlem saatleri

- Bakım

31 May 2022

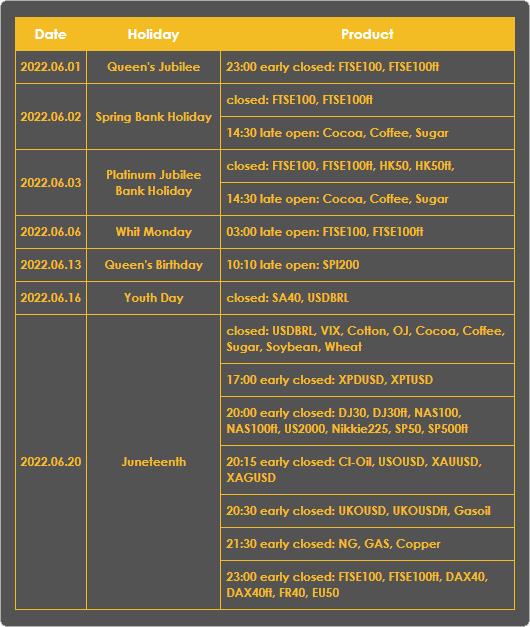

Ultima Markets Holiday Trading Hours Adjustment Notice

Dear Client,

Due to the impact of holidays, the trading hours of some products will also be changed and after the holiday, as follows:

Details:

Note: Please refer to the time shown in the MT4 product specifications.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

30 May 2022

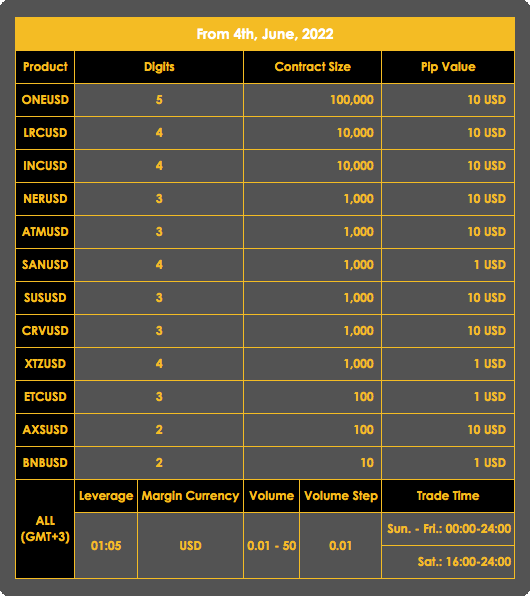

Ultima Markets New Products Launch Notice

Dear Client,

Ultima Markets is dedicated to providing the best trading environment and the widest range of products.

It’s our pleasure to announce that we will have 12 new products on June 4th, 2022, offering the investors more choices.

Details:

Note: Please refer to the above data shown in the MT4 product specification.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

27 May 2022

Ultima Markets June Futures Rollover Notice

Dear Client,

Ultima Markets futures contract products: VIX, USDX, FTSE100ft, NAS100ft, DAX40ft, SP500ft, DJ30ft, CL-OIL, UKOUSDft, CHINA50ft, HK50ft will be rolled over soon, please refer to the table below.

Since rollover is not due to market factors, the old futures contracts will be automatically rolled over during the switch between the old and new contracts, and the positions of futures contracts, you are holding, will be subject to a corresponding rollover charge to reflect the price difference between those two contracts.

Investors should properly control their positions or adjust their stop-loss settings accordingly before the rollover.

During the half-hour before and after the opening of the rollover day, we will prohibit all internal transfers from accounts in the same name due to rollover adjustments.

Details

Note: Please refer to the MT4 software for the above execution data.

If you have any questions or require assistance please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

26 May 2022

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices, and stocks, among more than 200 trading products.

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

19 May 2022

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices, and stocks, among more than 200 trading products.

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets