Please note that this website is not intended for EU residents. If you are located in the EU and wish to open an account with an EU investment firm and protected by EU laws, you will be redirected to Huaprime EU Ltd, a company licensed and regulated by the Cyprus Securities and Exchange Commission with licence no. 426/23.

Y A K L A Ş A N L A R

- Tümü

- Temettü

- Ürün güncellemeleri

- CFD Geçişi

- İşlem saatleri

- Bakım

28 October 2021

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices, and stocks, among more than 200 trading products.

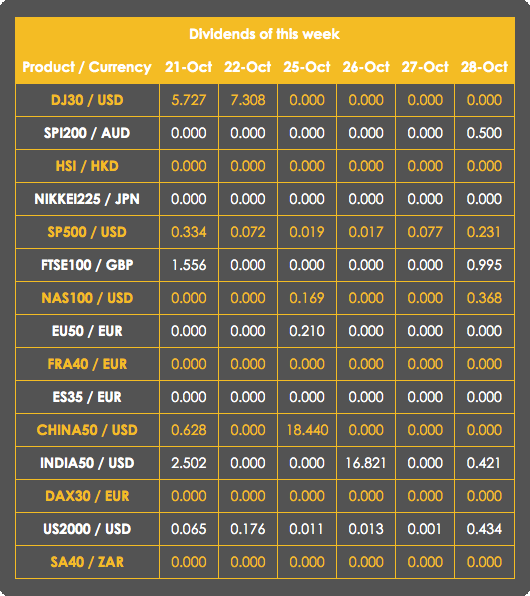

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

26 October 2021

Ultima Markets Notification of trading adjustment

Dear Client,

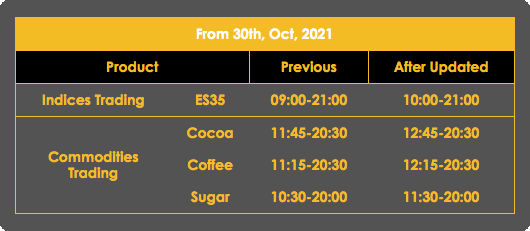

When Europe enters the winter time clock which begins in October 30th, 2021, the trading time of the following products will revise a hour late.

Details

Note: Please refer to the MT4 software for the above execution data.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

22 October 2021

Ultima Markets Notification of Server Upgrade

Dear Client,

As part of our commitment to providing the best reliability and service to our customers, we are planning an upgrade in our server on October 23rd, 2021.

As a result, we will be conduct maintenance according to the schedule below.

Start date and time: 2021-10-23 16:00 (GMT+3, server time)

End date and time: 2021-10-23 19:00 (GMT+3, server time)

The influence temporarily disables clients to log in to the trading accounts and the client portals. All the Crypto Currency products will not be able to trade during the maintenance. Please make sure your funds in the trading account are enough to afford the market changes, and the relevant settings of your positions.

After upgrading, clients can log in to the trading accounts and select the server which is shown in the account activation mail.

Our clients are not required to do anything. Your services will come back online at when the maintenance is finished.

We appreciate your patience and understanding on this matter.

If you have any questions, our team will be happy to answer your questions. Please mail to [email protected] or contact the service online.

Kind regards,

Ultima Markets

21 October 2021

Ultima Markets Index Dividend Adjustment Notice

Dear Client,

Ultima Markets is one of the world’s leading brokers, with multi-country regulation, and offers its clients a wide range of financial trading products, including currency pairs, precious metals, energy, indices, and stocks, among more than 200 trading products.

When the client is trading in Contracts for Difference (CFDs) on spot stock indices, if a component of the underlying stock index pays a dividend/dividend (payout) to its shareholders, your trading account will be adjusted ex-dividend at 00:00 server time on the same day and the corresponding gain or expense will occur depending on the position you holding and will be reflected in the account history.

Details

Note: The above data is expressed in the base currency of each index, the actual execution data may be subject to change, please refer to the MT4 software.

Please note that when the stock indexes go ex-dividend, the Dividend will be adjusted separately in the form of a capital recovery/deduction. You can check in your account history that the funds are adjusted with the following comment “Div & Index Name & Net Lot Size”, which is the dividend adjustment, where the long positions lot size is calculated as “positive” and the short positions lot size is calculated as “negative”, and the sum of the two is the “Net Lot Size”.

An example is as follows.

If you trade 5 lots long positions of NAS100, you can see the “Div & NAS100 & 5” adjustment in the account history in the form of balance; conversely, if you trade 5 lots short positions of NAS100, you can see the “Div & NAS100 & -5” payout adjustment in the account history in the form of balance.

If you are concerned about the impact of dividend payments on your account funds, we recommend that you carefully evaluate your current positions and consider whether to hold it overnight.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets

20 October 2021

Ultima Markets Oil Products Margin Percentage Adjustment Notice

Dear Client,

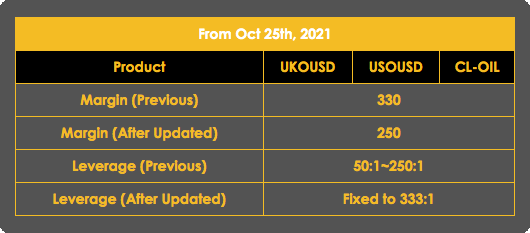

Ultima Markets will have adjustments in response to the recovery of the international financial market and the possible breakthrough of Oil prices. From October 25, 2021, the Margin Percentage and Leverage of the following Oil products will be changed: USOUSD, UKOUSD, CL-OIL.

Please refer to the following table for the relevant adjustment.

Details:

Note: The actual execution data may be subject to change, please refer to the MT4 software.

As a result, the margin requirement for trading Oil-related products will be decreased to about two-third of the previous level. The leverage level will be changed from 50-250 to 333 fixed leverage. The capital will be more sufficient for trading.

If you have any questions or require assistance, please do not hesitate to contact [email protected].

Kind regards,

Ultima Markets